About Do solar panels affect property taxes

Property taxes are fees levied by governments on individuals and organizations for ownership of specific types of property. The most common property taxes are for real property or real estate (buildings or land).

According to the National Renewable Energy Laboratory, the value of your home increases by $20 for every $1 in annual savings on utility bills. Data from the Energy Informatio.

Solar panels can increase the value of your home. When a home improvement project raises the value of a property, your local government can reassess the value of the home to de.

Essentially, property tax exemptions for solar panels will subtract the value of your solar installation -- or a portion of it -- from the assessed value of your home. If your house is w.

Sales tax exemptions for solar means that the equipment purchased -- such as solar panels, inverters, racking systems or optimizers -- isn't subject to the usual local consumptio.Solar panels are considered property enhancements, so they may increase your home’s overall value and property tax assessment. Some 35 states offer solar tax property exemptions, meaning solar homeowners don’t have to pay property tax hikes when solar panels raise their home’s tax valuation.

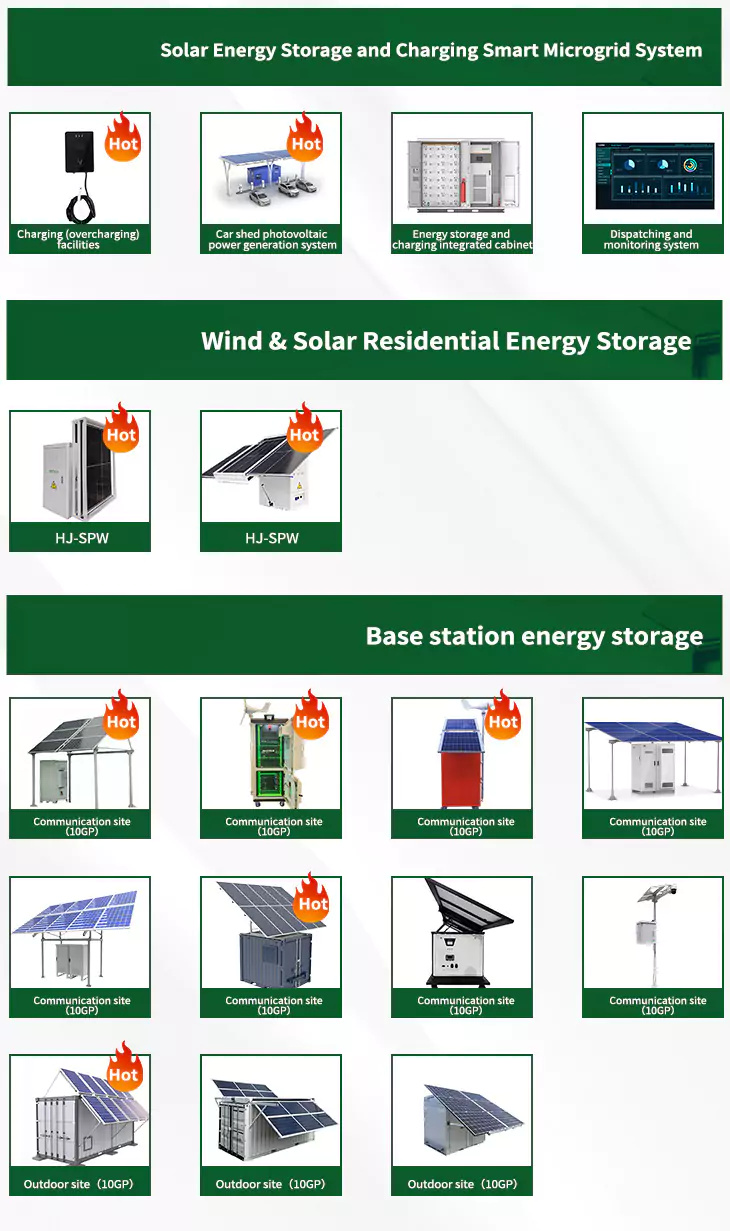

As the photovoltaic (PV) industry continues to evolve, advancements in Do solar panels affect property taxes have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Do solar panels affect property taxes for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Do solar panels affect property taxes featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Does temperature affect solar panels

- How to claim solar panels on taxes

- Will an emp affect solar panels

- Do solar panels increase the value of your property

- Do clouds affect solar panels

- Do you own solar panels

- Solar grid panels

- Best type of solar panels

- Solar panels for deer feeders

- How do solar panels work in the snow

- Does solar panels save money

- Can you use artificial light for solar panels