About How to claim solar panels on taxes

Learn how to claim the 30% Residential Clean Energy Credit for your solar system installation from 2022 to 2032. Follow the step-by-step guide with IRS forms, calculations and examples.

The Residential Clean Energy Credit (also known as the solar investment tax credit or ITC) is a tax credit for homeowners who invest in solar and/or battery storage. Thanks to the Inflation Reduction Act, the 30% credit is available for homeowners that install solar from.

Fill inForm 1040as you normally would. When you get to line 5 of Schedule 3 (Form 1040), shown below, it’s time to switch to Form 5695.

Calculating the amount of your federal solar tax credit is very simple. Take the total cost your system and multiply it by 0.30. For example, if you spent $25,000 all-in on going solar (parts, labor, permits, etc), then your tax credit would be worth $7,500. $25,000.To claim the solar tax credit on your taxes, follow these steps:File IRS Form 5695 as part of your tax return12345.Calculate the credit on Part I of the form.Enter the result on your Form 1040.Make sure you have the necessary information, including the address of your main home where the solar panels were installed1.Obtain certification from the equipment's manufacturer that shows it is eligible for the credit5.

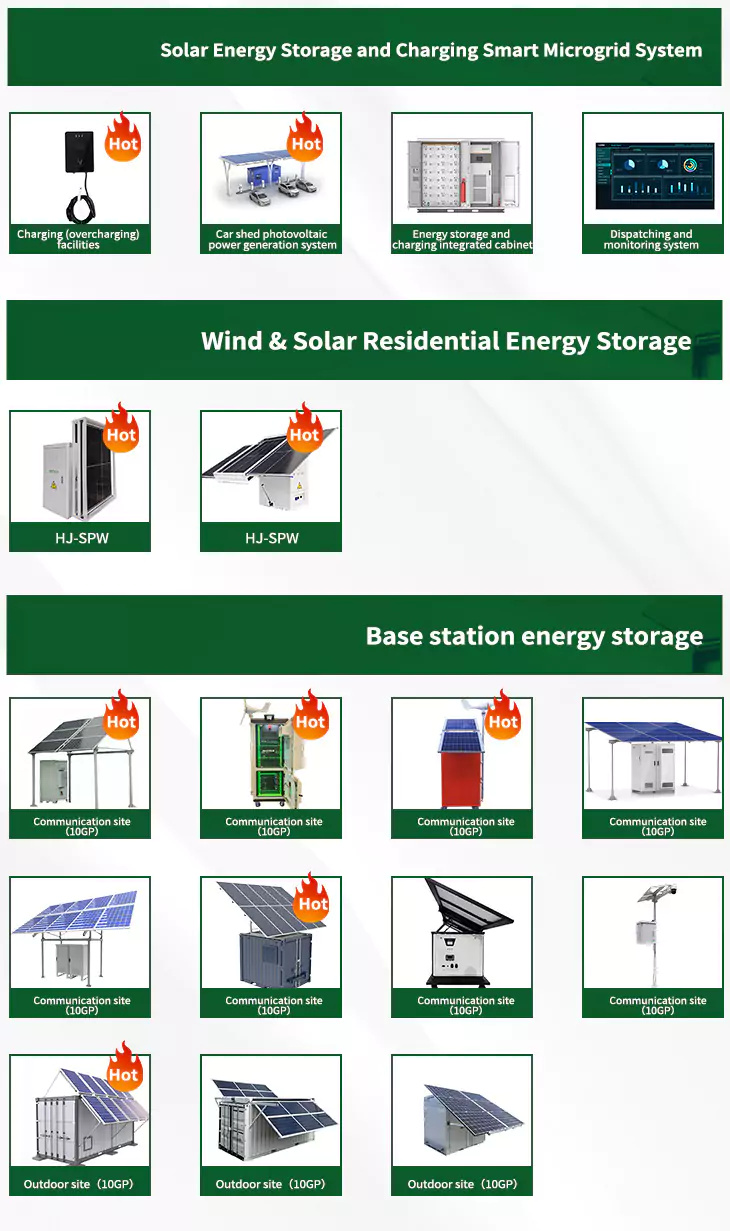

As the photovoltaic (PV) industry continues to evolve, advancements in How to claim solar panels on taxes have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient How to claim solar panels on taxes for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various How to claim solar panels on taxes featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- How to claim tax credit for solar panels

- How do solar panels work in the snow

- How to connect solar panels with inverter

- How many solar panels for a 15kw system

- How do photovoltaic solar panels work

- How to wire multiple solar panels

- How do i clean my solar panels

- How many kwh will solar panels produce

- How long to solar panels last

- How much do ground mounted solar panels cost

- How to wire up solar panels

- How to connect two solar panels together