About Solar energy incentives in new jersey

New Jersey offers tax incentives and rebates to encourage residents to participate in its clean energy initiatives, making the switch to solar power more affordable and appealing.

Residents of New Jersey can take advantage of the federal solar credit program, which has.

In New Jersey, the average cost of installing a residential solar system is $2.75 per watt, or $13,750 for a 5-kW system, before any tax credits or incentives are included.

The decision to go solar involves an upfront investment and a long-term commitment. However, when considering the benefits and incentives available in New Jersey, the answer is.Solar incentives available in New Jersey12345:Successor Solar Incentive (SuSI) Program: $85 per 1,000 kilowatt-hours (kWh) of energy generated.New Jersey solar energy sales tax exemption: 100% exemption on state sales tax (6.625% of purchase value).New Jersey property tax exemption for renewable energy systems: Varies based on property and system type and size.Federal solar tax credit: 30% federal tax credit.Net metering: Offers additional long-term savings on energy bills.

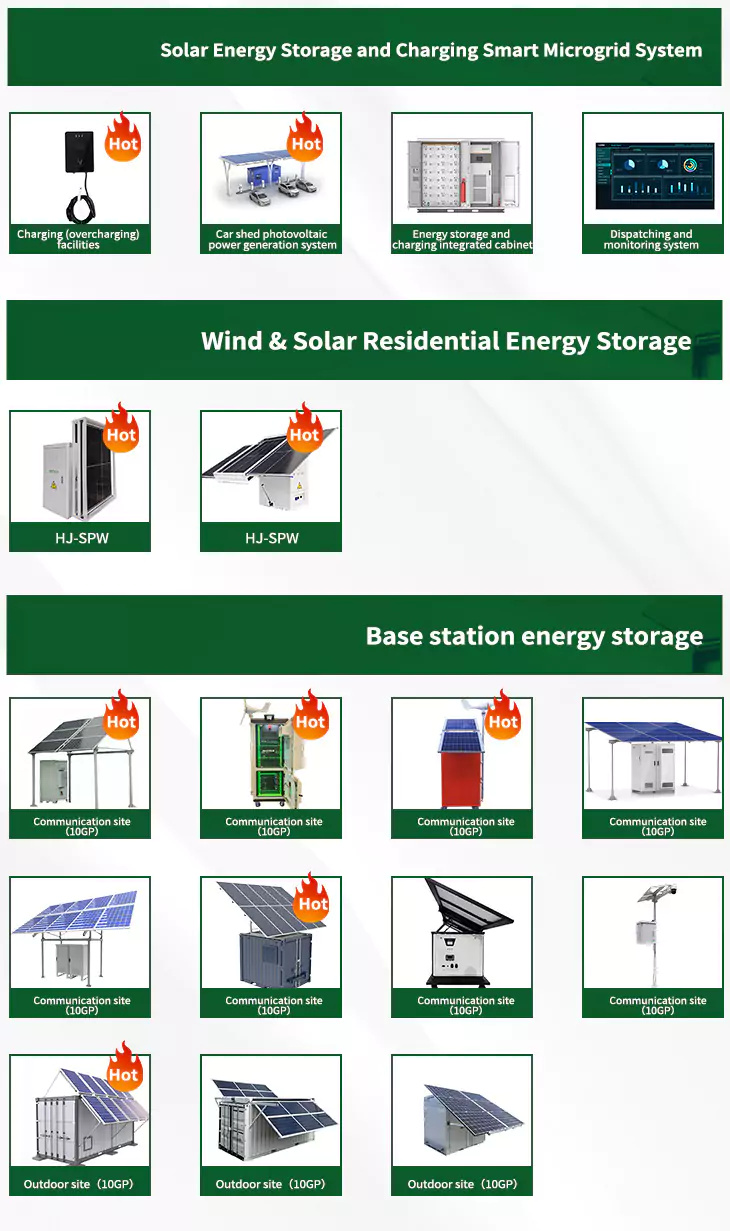

As the photovoltaic (PV) industry continues to evolve, advancements in Solar energy incentives in new jersey have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Solar energy incentives in new jersey for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Solar energy incentives in new jersey featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Solar energy training new jersey

- New jersey community solar energy pilot program

- Solar energy new technology

- Pa solar energy incentives

- Solar energy companies in new england

- Reliance new energy solar ltd share price

- Solar energy new york state

- Bloomberg new energy finance china solar

- Ohio solar energy incentives

- Duke energy solar incentives florida

- List of solar companies in new jersey

- New mexico solar energy tax credit