About Do solar tubes qualify for energy credit

The federal tax credit applies to the cost of qualified Solatube products and installation. Accessories and add-ons, such as the Light Kit or Ventilation Kit are excluded.

You’ll need your receipt for purchase and installation, a Manufacturer’s certification (see above), and IRS Form 5695. On this form, in line 1: Qualified solar electric property co.

Existing homes and new construction qualify; as well as primary residences and secondary residences, such as vacation homes. Rental properties do not qualify.

In December 2015, legislation was signed into law that extended the Solar Investment Tax Credit (ITC), which provides for a federal income tax credit for residential photovoltai.

All Solar Star Attic Fans are considered residential photovoltaic systems, which means they turn sunlight into energy, so a portion of the cost of the fans qualifies for a federal inco.Solar tubes are devices that capture natural light and deliver it to indoor spaces. Some solar tubes qualify for federal energy tax credits12. These include Solatube Integrated Solar Daylighting Systems 160 and 290 when integrated with a Solar Electric Nightlight or a Solar-Powered Daylight Dimmer1. Also, solar tubes with night LED lights qualify for the tax credit because they have a small solar panel inside them2.

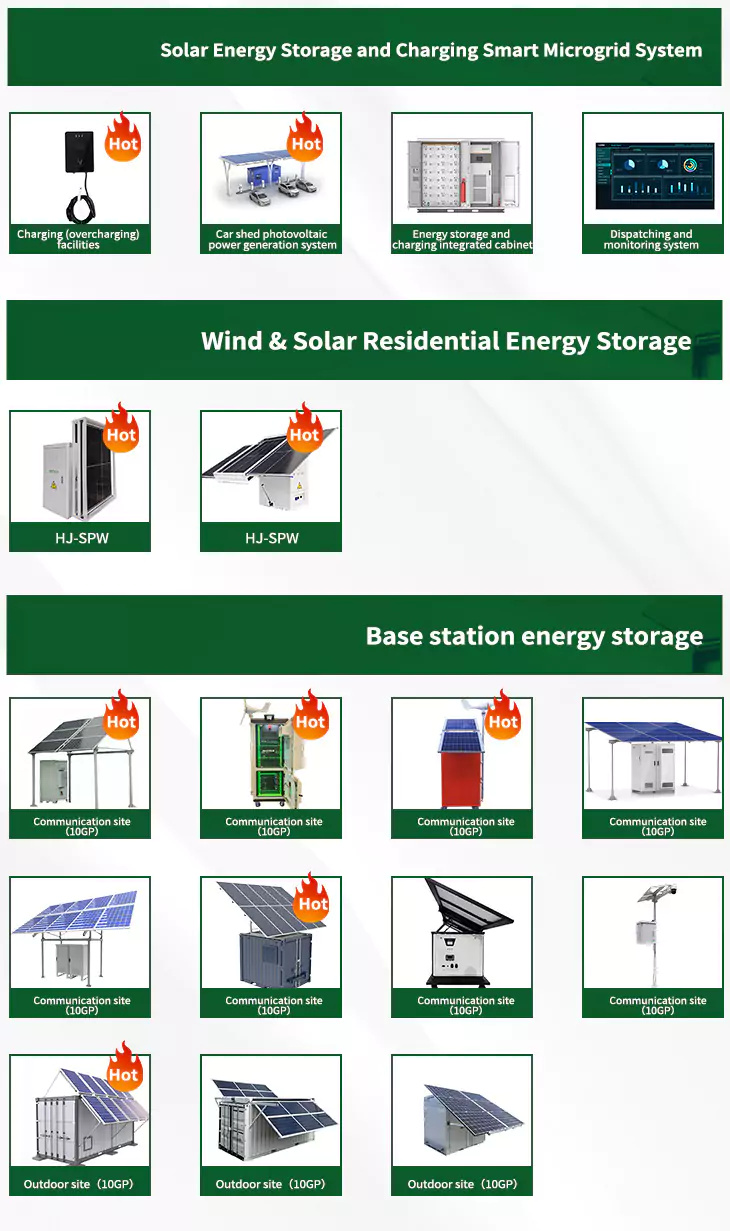

As the photovoltaic (PV) industry continues to evolve, advancements in Do solar tubes qualify for energy credit have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Do solar tubes qualify for energy credit for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Do solar tubes qualify for energy credit featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Do leased solar panels qualify for energy credit

- Solar energy federal tax credit

- 2015 ma energy credit for solar and wind

- 2108 solar energy tax credit

- Sc solar energy tax credit

- Solar energy tax credit 2019

- New mexico solar energy tax credit

- Claim for solar energy system equipment credit

- Business solar energy tax credit 2016

- Solar energy tax credit form

- 2024 solar energy credit

- Nys tax credit for payments to solar energy company