About Solar power leasing for small businesses

This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities, including both photovoltaic (PV) and concentrating solar-thermal power (CSP) en.

To be eligible for the business ITC or PTC, the solar system must be: 1. Located in the United States or U.S. territories 2. Use new and limited previously used equipment 3. Not leased.

The ITC is an upfront tax credit that does not vary by system performance, while the PTC can provide a more attractive cash flow, as the tax credits are earned over time. Whet.

While the PTC is calculated based on the electricity produced by a system, the ITC is calculated based on the cost of building the system, so understanding what expenses are eligible.

To qualify for the full ITC or PTC, projects which commenced construction prior to January 31, 2023, must satisfy the Treasury Department’s labor requirements: all wages for construc.

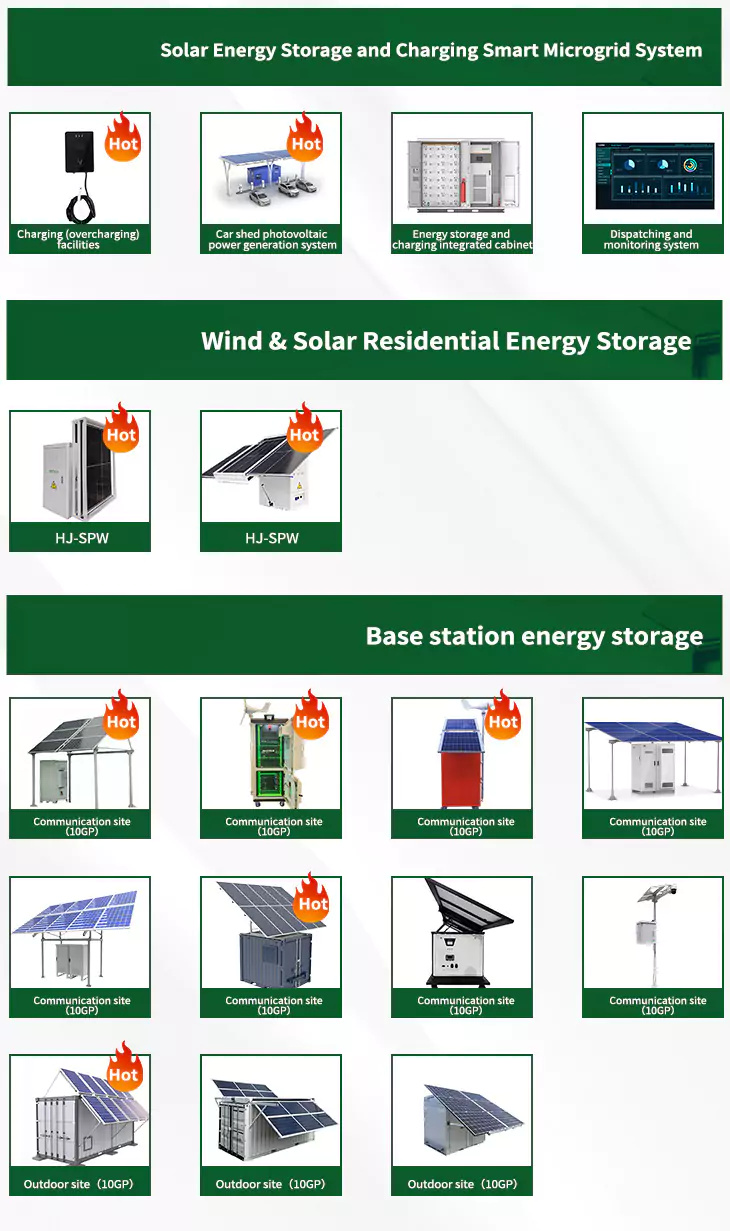

As the photovoltaic (PV) industry continues to evolve, advancements in Solar power leasing for small businesses have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Solar power leasing for small businesses for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Solar power leasing for small businesses featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- How to build a small solar power system

- How to set up a small solar power system

- Building small solar power system

- Solar power for small shop

- Does solar power produce carbon dioxide

- 3000 watt solar power inverter

- Lyrics solar power

- Charge worx solar power bank

- Commercial solar power storage system

- Bannura solar power project llp

- Solar power toy car

- Go power solar panels for sale