About Can a ltd company be a sole trader

When a business approaches the VAT registration threshold (which means that turnover is getting near the magic £90,000 mark), it’s required to register for VAT. Sole traders with multiple businesses work out th.

On a very practical level – you need to make sure that any expenses you claim(bills, travel costs, broadband etc) are attributed to the right business. Otherwise, you could end up with one heck of an accounting.

In keeping the businesses separate, make sure you’re really clear what work was carried out by which business. Perhaps all current clients will go through your sole trader business and from now on new ones will go thro.

The only way to answer this question is to weigh up the pros and cons of being a sole trader versus incorporating the business to become a limited company. The way you run your business, its turnover, and your personal cir.

If there are very strong reasons for separating different business ventures (and you truly keep them separate) this is generally acceptable. Just remember that HMRC will be on the lookout for businesses who deliber.Yes, you can run a limited company and be a sole trader at the same time, but it is crucial to keep the two businesses totally separate1. A limited company can still be owned by a single proprietor, in a similar way to how a sole trader operates2. Even in this case, the owner and business are still seen as individual entities in the eyes of the law2. If you want to change from a limited company to a sole trader, you will need to either apply to get the company struck off the Register of Companies, or start a members' voluntary liquidation3.

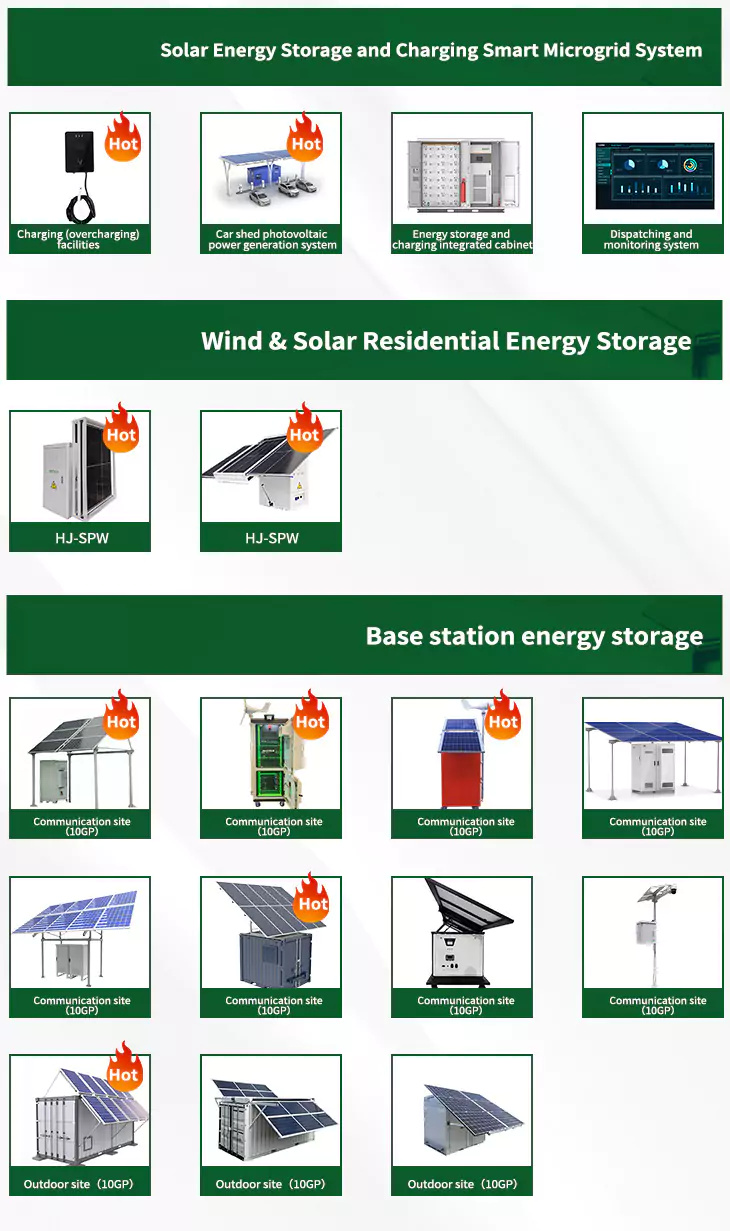

As the photovoltaic (PV) industry continues to evolve, advancements in Can a ltd company be a sole trader have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Can a ltd company be a sole trader for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Can a ltd company be a sole trader featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- From sole trader to company

- Disadvantages of a sole trader and a public company

- Company sole trader

- Advantage and disadvantage of sole trader partnership and company

- Is sole trader a limited company

- Benefits of being a sole trader or limited company

- Sole trader vs partnership vs company

- Setting up a business sole trader or limited company

- Is a sole trader a close company

- Sole trader vs limited company tax calculator

- Should i register as a sole trader partnership or company

- Company sole trader partnership