About Solar energy tax credits 2023

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy propertyfor your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. You may be.

Qualified expenses include the costs of new clean energy propertyincluding: 1. Solar electric panels 2. Solar water heaters 3. Wind.

You may claim the residential clean energy credit for improvements to your main home, whether you own or rent it. Your main home is generally where you live most of the time.

Clean energy property must meet the following standards to qualify for the residential clean energy credit. Solar water heatersmust be certified by the Solar Rating Certification.

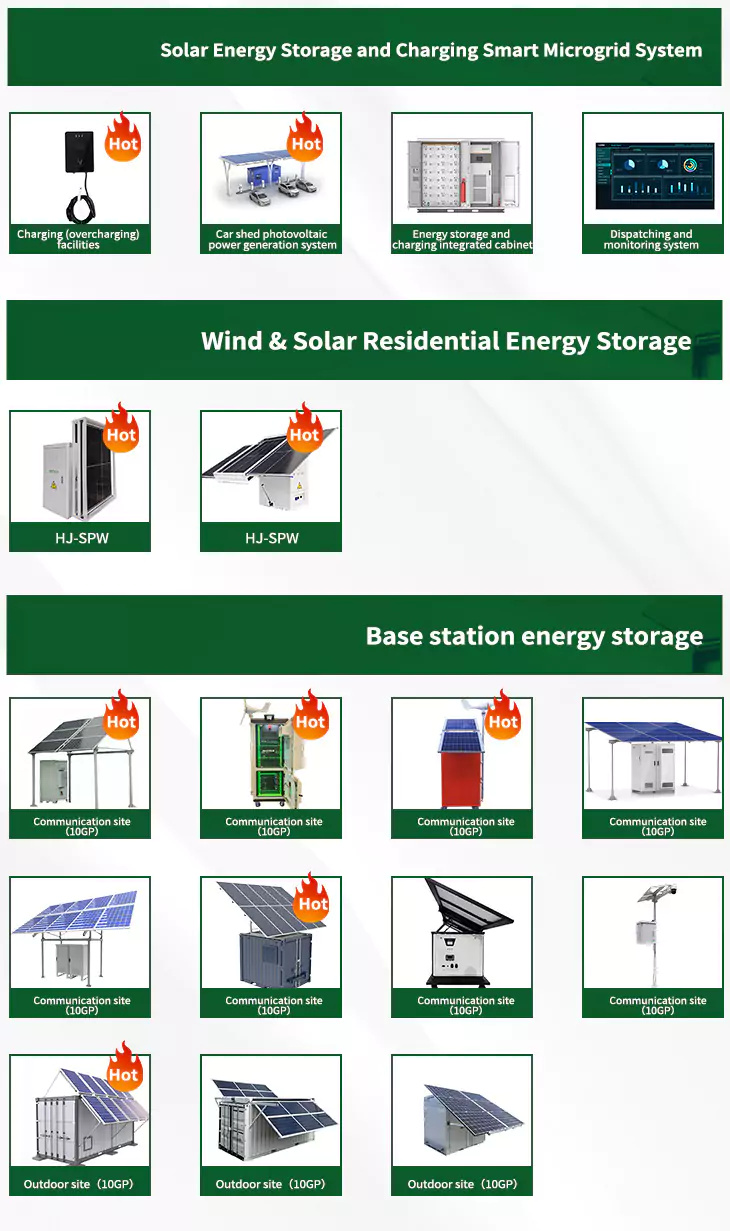

As the photovoltaic (PV) industry continues to evolve, advancements in Solar energy tax credits 2023 have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Solar energy tax credits 2023 for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Solar energy tax credits 2023 featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Solar energy tax credits

- Solar energy federal tax credit

- 2108 solar energy tax credit

- Sc solar energy tax credit

- Solar energy tax credit 2019

- Wood mackenzie solar and energy storage summit 2023

- Solar energy articles 2023

- New mexico solar energy tax credit

- Tax credits solar panels

- Solar energy credits 2024

- Business solar energy tax credit 2016

- Solar energy tax credit form