About Banks and renewable energy

Before they can set objectives, decision makers need to establish their starting point. The emission baseline is a “footprint”—a measure of emissions in a specific time period, such as a year—that is taken as the starting point against which to measure change. A robust and accurate baseline is critical to.

Banks should build a momentum case—a view about what will happen to a given sector or given counterparty—for each sector. The.

Once a bank understands the momentum case, it can model what it would take to align the portfolio with the Paris Agreement. In practice, there is not just one “Paris aligned”.

For banks to reach targets, they must embed their NetZero commitments into their operations, including their commercial.

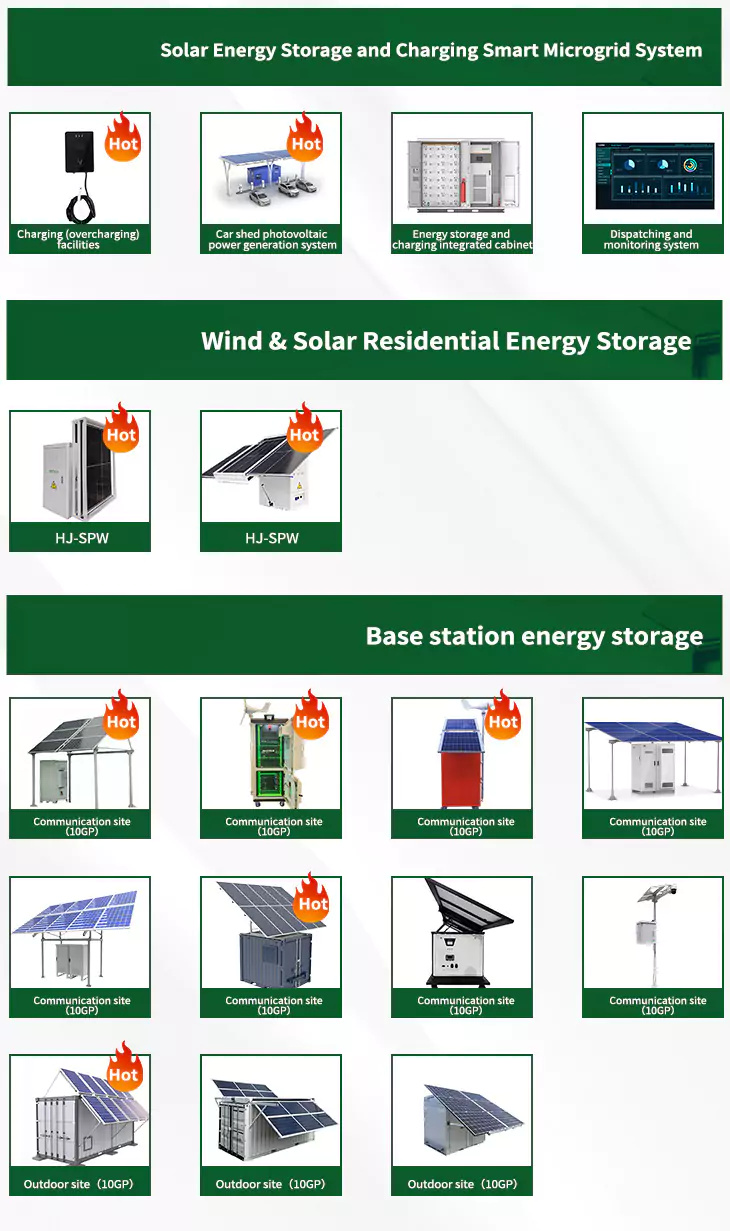

As the photovoltaic (PV) industry continues to evolve, advancements in Banks and renewable energy have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Banks and renewable energy for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Banks and renewable energy featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Aventine renewable energy canton llc

- Renewable energy best countries

- What is the most commonly used renewable energy source

- Renewable energy accelerator

- Adelsheim renewable energy

- 3 pros of renewable energy

- Who is leading the world in renewable energy

- Texas renewable energy credits

- What are the 8 types of renewable energy

- Renewable energy investment trust

- 2018 outlook on renewable energy

- Eagle renewable energy