About Lithium battery etf stocks

The Amplify Lithium & Battery Technology ETF is the second pure-play lithium battery ETF available in the U.S. At just 0.59% per year, it has an even lower expense ratiothan Global X’s offering. The fund is made up of 90 stocks, so it also covers more ground. But more stocks and lower expenses have.

The iShares Global Clean Energy ETF isn’t solely focused on lithium production and batteries. Rather, this ETF has a wider scope, with investments in clean energy companies.

The First Trust NASDAQ Clean Edge Green Energy Index Fund is another broad-based ETF that covers all things renewable energy. The fund has amassed a sizable following, with $2.2 billion in assets under management, and it charges a 0.58% annual fee.

The final option on this list comes from famous growth investor Cathie Wood’s company ARK Invest One of its funds, Ark Autonomous Technology & Robotics ETF, lists “energy storage”.7 Best Lithium Stocks and ETFs to Buy in 2024Albemarle Corp. (ALB)Mineral Resources Ltd. (OTC: MALRY)Sociedad Química y Minera de Chile SA (SQM)Arcadium Lithium PLC (ALTM)Ganfeng Lithium Group Co. Ltd. (OTC: GNENF)Global X Lithium & Battery Tech ETF (LIT)Global X Lithium Producers Index ETF (HLIT.TO)

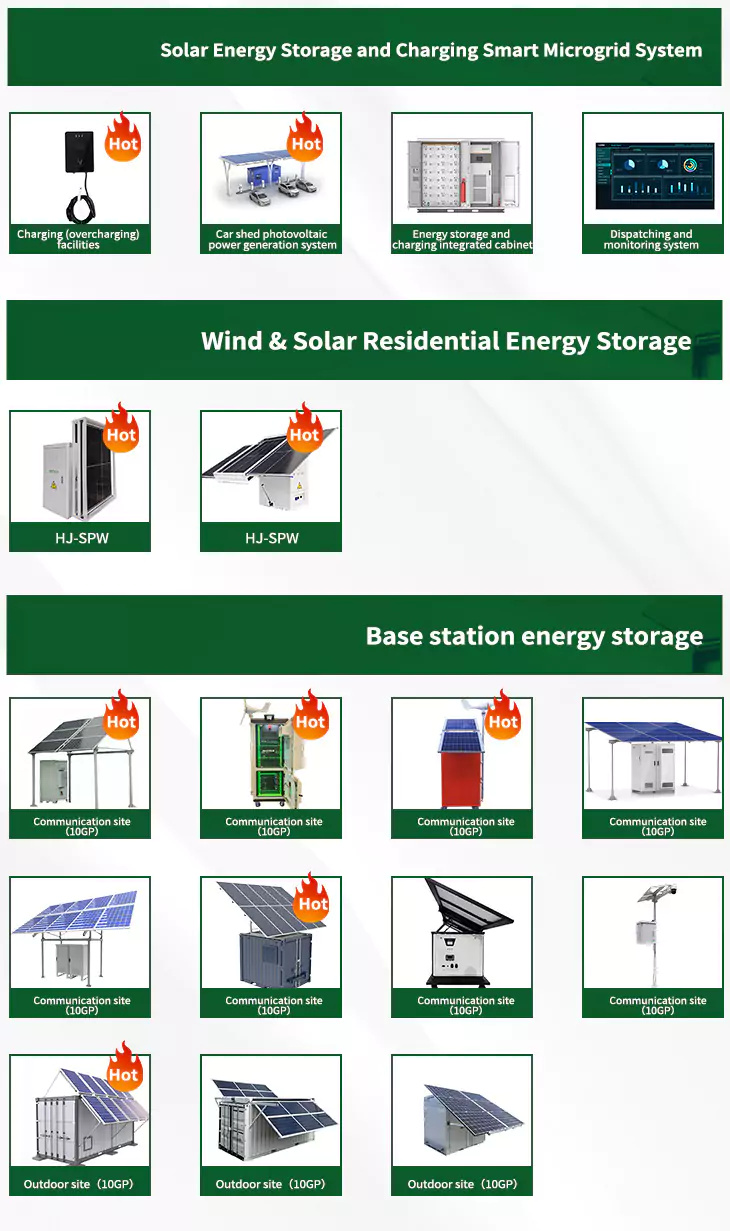

As the photovoltaic (PV) industry continues to evolve, advancements in Lithium battery etf stocks have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Lithium battery etf stocks for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Lithium battery etf stocks featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Lithium battery ev stocks

- Battery and lithium etf

- Global lithium battery etf

- Lithium ion battery stocks to buy

- Duracell 3 volt lithium battery dl1 3n

- Craftsman 19 2 lithium ion battery

- Testing lithium battery with multimeter

- Craftsman lithium ion battery 40 volt

- Lithium battery cr2032 3v

- 72v 32ah lithium battery

- Chins 400ah lithium battery

- Lithium battery will not charge