About Can a llc sole proprietor company deduct donations

A partnership doesn’t pay income taxes. All income and expenses, including deductions for charitable giving, are passed to the partners on their individual Schedule -1 forms. Whe.

Before you make any business donations to charity, you need to make sure that the charity you’re donating to has been qualified by the IRS. The IRS defines a charitable o.

Sole proprietors may be able to deduct charitable contributions made by their business. For single member LLC charitable contributions, business income is passed thr.

Cash payments made to an organization (whether they have charitable status or not) can be classified as business expenses. However, these payments must be neither charitable c.

Charitable donations include cash donations, sponsorships of events and in-kind contributions, for example, donation of equipment or inventory. Mileage and travel expenses incurred while working for a charitable organization can also be considered business donations to charity. You can also deduct intellectual.

A partnership doesn’t pay income taxes. All income and expenses, including deductions for charitable giving, are passed to the partners on their individual Schedule -1 forms. When a partnership makes a charitable donation, each partner takes a percentage.

Sole proprietors may be able to deduct charitable contributions made by their business. For single member LLC charitable.

Before you make any business donations to charity, you need to make sure that the charity you’re donating to has been qualified by The IRS.

Cash payments made to an organization (whether they have charitable status or not) can be classified as business expenses. However, these payments must be neither charitable contributions or gifts – nor can they be directly related to your business. Charitable.Rules For Sole ProprietorsIn general, if you make a donation to a registered 501 (c) (3) charitable organization and you received nothing in return, then you can take a deduction for your donation as an itemized deduction on your individual tax return. From a business perspective, you could still announce your business’ intention to make a donation but simply have it be a personal donation.

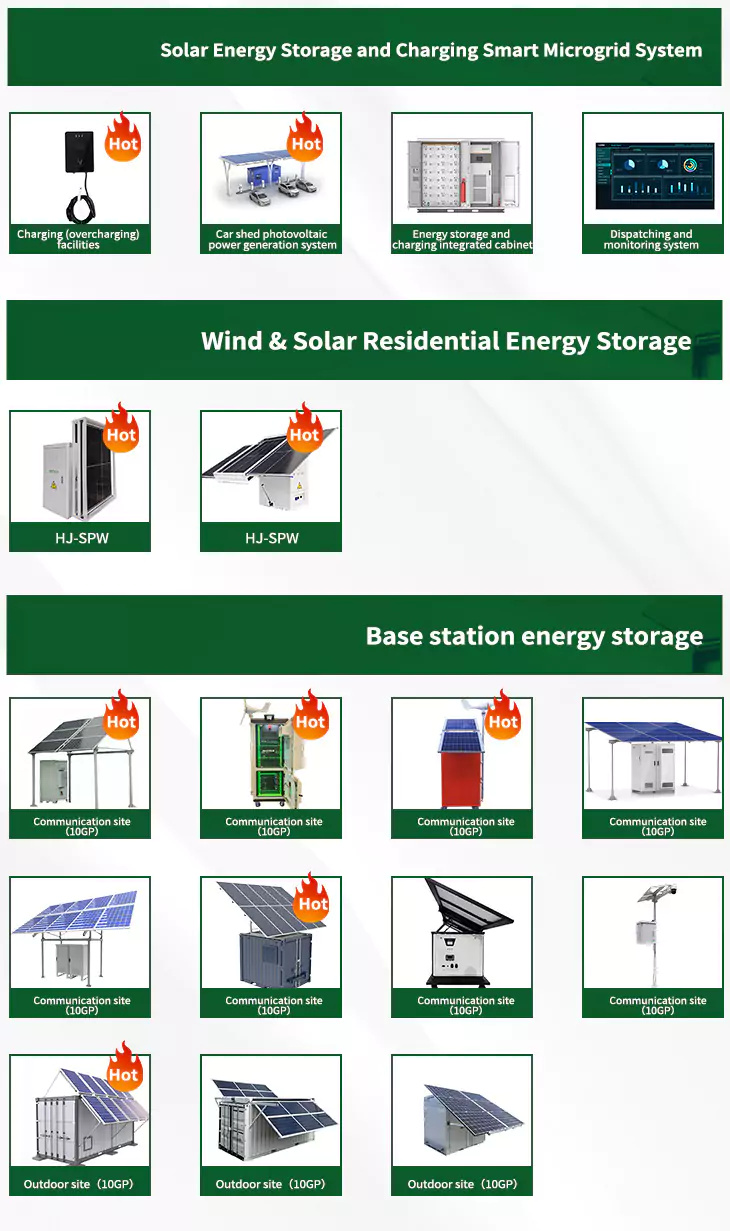

As the photovoltaic (PV) industry continues to evolve, advancements in Can a llc sole proprietor company deduct donations have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Can a llc sole proprietor company deduct donations for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Can a llc sole proprietor company deduct donations featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Lease a company car for sole llc

- Can a company be sole proprietor

- How to register a sole proprietor company

- Limited liability company corporation s-corporation sole proprietor

- Company vs sole proprietor

- That solar company llc reviews

- Solid equipment company llc

- Solo cup company llc

- Downeast solar company llc

- Philadelphia solar company llc

- Sola company llc

- Imperial valley solar company ivsc 1 llc